- KOR

- ENG

Short-term Export Credit Insurance (General)

- HOME

- Our Products & Services

- Short-term Products

- Short-term Export Credit Insurance (General)

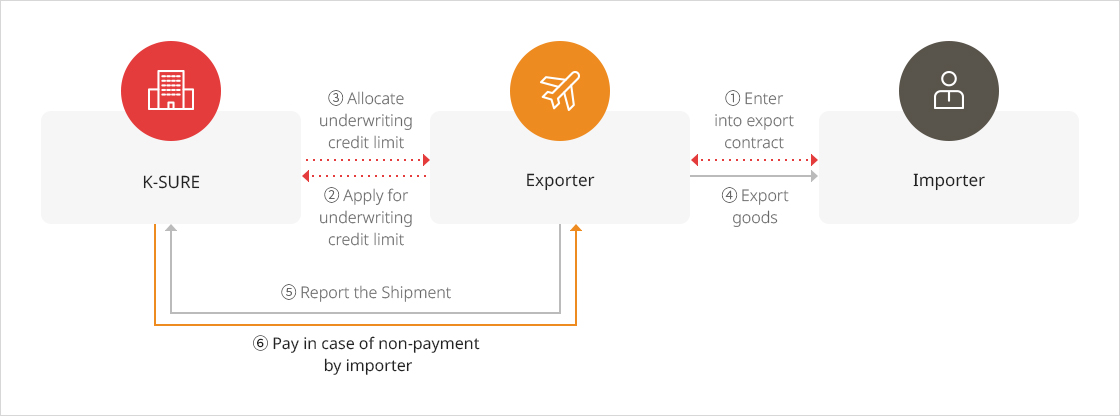

- This scheme is to cover an importer or a L/C issuing bank (policyholder) from the non-payment risk in transactions with less than two years of payment period. It is the most frequently used program among various export insurance schemes.

Overview of Scheme

Overview

Short-term Export Credit Insurance insures exporters against the risk of buyer(or L/C issuing bank) nonpayment under an export contract with less than 2 years of credit period.Product Characteristics

Scheme to cover (both commercial risk and political risk)Product Structure

Target Transactions

General export, Consignment Processing Trade, intermediary trade, and resale transactions within two years of the settlement period※ According to the characteristics of export credit insurance, the insurance applies only when losses occur in an export contract. It applies limitedly to export at charge, not free-of-charge export.

- Point of Contact : Business Coordination Department