- KOR

- ENG

Medium and Long-term Export Credit Insurance (Buyer Credit)

- HOME

- Our Products & Services

- Medium and Long-term Products(L~N)

- Medium and Long-term Export Credit Insurance (Buyer Credit)

Overview of Scheme and Product Characteristics

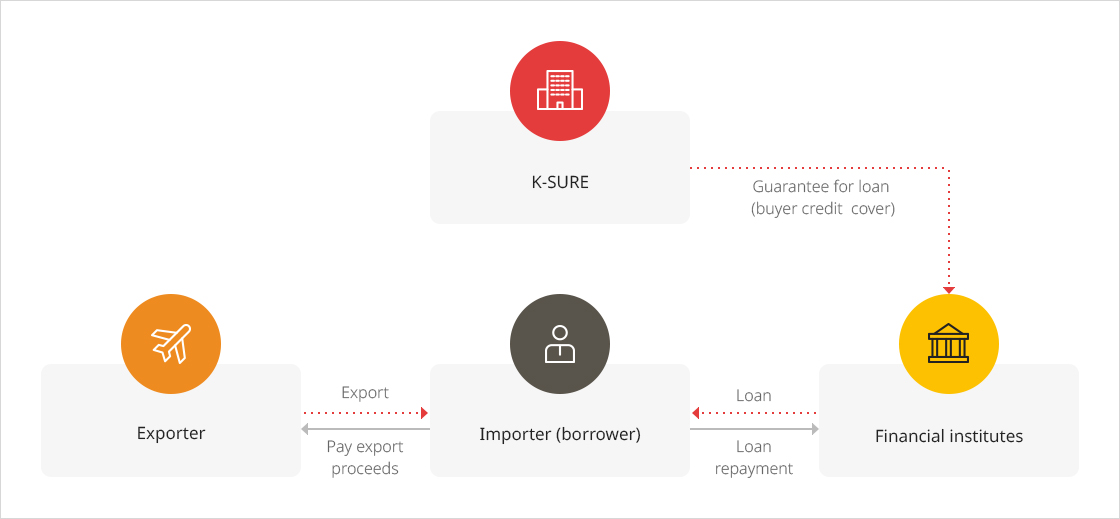

This scheme covers the risk of financial institutes becoming unable to collect the principal and interest of loans in Medium and long-term export transactions for which the settlement period of export proceeds exceeds two years.- It provides coverage for domestic and overseas financial institutes becoming unable to collect the principal and interest of buyer credit loans provided on a deferred payment basis with the repayment period exceeding two years to importers or banks of importing countries in relation to medium and long-term exports of capital goods, etc.

Product Structure

Target Transactions

Export contract of which the settlement period of export proceeds (base date of credit - final payment due date) exceeds two yearsRisks Covered

| Category | Description |

|---|---|

| Political Risks |

|

| Commercial Risks |

|

※ Special Reasons: Importer’s unreasonable demand to change contract conditions, importer’s request to extend the payment due date or shipping due date by one year or longer, deferment of pre-shipment payment for one year or longer, etc.

- Point of Contact : Project Finance Coordination Department